France Hits Big, Wealthy Companies to Cut ‘Big Debt’

(Bloomberg) — The French government unveiled next year’s budget that aims to provide a 60.6 billion euro ($66.2 billion) bailout for its ailing public finances and build investor confidence even at the risk of being kicked out by a hostile parliament.

Most Read from Bloomberg

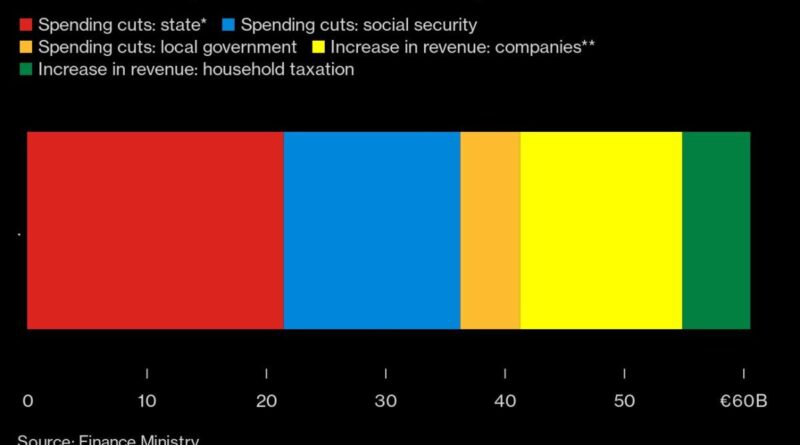

The spending cuts will be more than two-thirds of what Finance Minister Antoine Armand called an unreasonable fiscal effort, with the rest coming from higher taxes on businesses, the wealthy and energy.

“Our country is at an unprecedented time, and at a critical time,” he told reporters during a late-minute bill introduction on Thursday. “The French economy is still stable, but our public debt is huge. It would be ridiculous and fatal not to see it, to talk about it and to take care of it.”

The 2025 budget is an important part of Prime Minister Michel Barnier’s efforts to restore political and fiscal order after months of uncertainty and uncertainty caused by President Emmanuel Macron’s decision to dissolve the National Assembly and convene quick options.

Under the plans, temporary tariffs on 440 profit-making companies with an annual revenue of more than €1 billion next year and €4 billion in 2026. A special tax on maritime transport companies will contribute €500 million and €300 million. in those same years.

The government will also propose to increase the tax on airline tickets and the tax on the use of private aircraft. The purchase of company stock will also be subject to a special tax when the shares are cancelled.

As for individuals, about 65,000 families will face higher taxes that are expected to bring in € 2 billion next year. The budget will put 20% on the rate for people earning €250,000 a year, or couples earning twice that amount. The measures are aimed at combating the effects of tax houses that they can benefit from.

The budget is based on a forecast of 1.1% growth in gross domestic product next year, a figure that Armand said takes into account the negative impact of the measures.

However, France’s HCFP high court that reviews financial debt has said that macroeconomic considerations are “weak” because the size of the merger means pressure on economic growth.

Investor confidence took a hit as the political turmoil of a hung parliament coincided with a sharp decline in the budget deficit, particularly as tax receipts collapsed. A selloff in French bonds drove the country’s premium on 10-year debt relative to Germany to nearly 80 basis points from less than 50 before the election.

The government is committed to reducing the deficit to 5% of economic output by 2025 from a forecast of 6.1% for this year, and has warned that it will rise to 7% without action. It has already pushed back the goal of respecting the European Union limit of 3% for two years until 2029. In comparison, Italy expects to be under that level in 2026.

“I don’t think the markets see this deficit reduction as a big success,” Hauke Siemssen, a ratings analyst at Commerzbank AG, said before the budget was released.

Europe’s second largest economy will also soon face the judgment of the world’s three largest credit rating agencies. Fitch Ratings, which downgraded France last year, may issue a new assessment later on Friday, followed by Moody’s Ratings on Oct. 25 and S&P Global Ratings a month later.

Despite its weak deficit, France will have to sell a record 300 billion euros in bonds to make ends meet next year. The cost of servicing the mountain of national debt is expected to rise to €54.9 billion, according to the Ministry of Finance.

While the minority government made up of centrists Macron and conservatives Barnier must convince investors its budget plans are credible to avoid rising costs, it is also need to face lawmakers who can drive it out of office.

A vote of no confidence by the left-wing New Popular Front alliance failed earlier this week, but the Prime Minister and her party would be ousted if far-right Marine Le Pen’s National Rally I returned another test.

The government’s budget plan will begin to be considered in parliament next week. Lawmakers can introduce amendments and the bill should be approved by the end of the year. Without a majority, the government would need to use article 49.3 of the constitution to override the bill’s vote, increasing the chances of impeachment.

The challenge for Barnier is not so much to get direct support, but to find a measure of measures acceptable enough for Le Pen to refuse to align with the left to bring down the government.

Pension ‘Theft’

Even before Thursday’s proposal, Le Pen had criticized some of the proposals, saying the plan to reduce costs by delaying the indexation of pensions until July 1 would amount to “theft.”

However, Barnier has maintained the balance, which the draft budget has predicted will bring in 3.6 billion euros from the 14.8 billion euros of savings. public safety. The government also plans to reduce the number of civil servants by about 2,200 jobs.

Barnier risks opposition from among lawmakers who support his government. Some centrists have said they would not favor a tax hike that risks undermining years of Macron’s trade policies that they say are crucial to supporting jobs and growth.

One of the president’s signature policies to encourage investment was to reduce the tax rate to 25% from 33.3%. The temporary measures of the budget bill would make next year equal to 30% for companies with more than €1 billion of annual revenue and 36% for those with more than € 3 billion. Rates would drop to 28% and 30% respectively the following year.

Companies have already raised concerns about the budget’s impact on the economy. According to France’s largest trade association, Medef, hundreds of thousands of jobs could be at risk if the government goes ahead with plans to pay low-wage tax breaks. The measure is expected to save €4 billion.

“We are asking companies to make a real effort, but my goal as economy minister is to ensure that these efforts have the least impact on employment,” Armand told Le Figaro newspaper in an interview.

Patrick Pouyanne, chief executive officer of oil giant TotalEnergies SA, said the balance between spending cuts and taxes on the wealthiest businesses and individuals “seems acceptable,” adding that the company France’s fourth largest by market value will not oppose the proposed tax. on the share price if it stays at 1%.

“There needs to be a response to the growing inequality,” he told Les Echos newspaper in an interview. However, “all these additional taxes must be accompanied by a significant reduction in public revenue.”

–With the help of Francois de Beaupuy and Valentine Baldassari.

(Updates on the assessment period of the rating agency in paragraph 13, the Minister of Finance comments in paragraph 24, the CEO of TotalEnergies comments in the previous two paragraphs.)

Best Reads from Bloomberg Businessweek

©2024 Bloomberg LP

#France #Hits #Big #Wealthy #Companies #Cut #Big #Debt