Milton created a stock market

Weekly Chart: National Tender Rejection Index – USA SONAR: OTRI.USA

National outbound tender rejection rates (OTRI), the rate at which carriers reject requests from their customers for truck power, went from 5.13% to 5.62% as of Oct. 8 to Oct. 9 as Hurricane Milton closes in on Florida’s west coast. This was the biggest one-day race in the last two years. What are the takeaways for transport providers and operators after the third major transport market disruption to arrive in less than a month?

Hurricanes can cause major changes in North American transportation markets, typically making trucking more difficult. For days, shipping facilities, infrastructure such as roads and warehouses have been damaged, and there will be a series of relief efforts for carriers.

Hurricane Harvey in 2017 was the primary cause of one of the longest truck market shutdowns in the past 20 years outside of COVID.

In the days leading up to a hurricane, carriers avoid dangerous driving — as they should. Carriers may send additional orders while trying to get their cargo out of harm’s way.

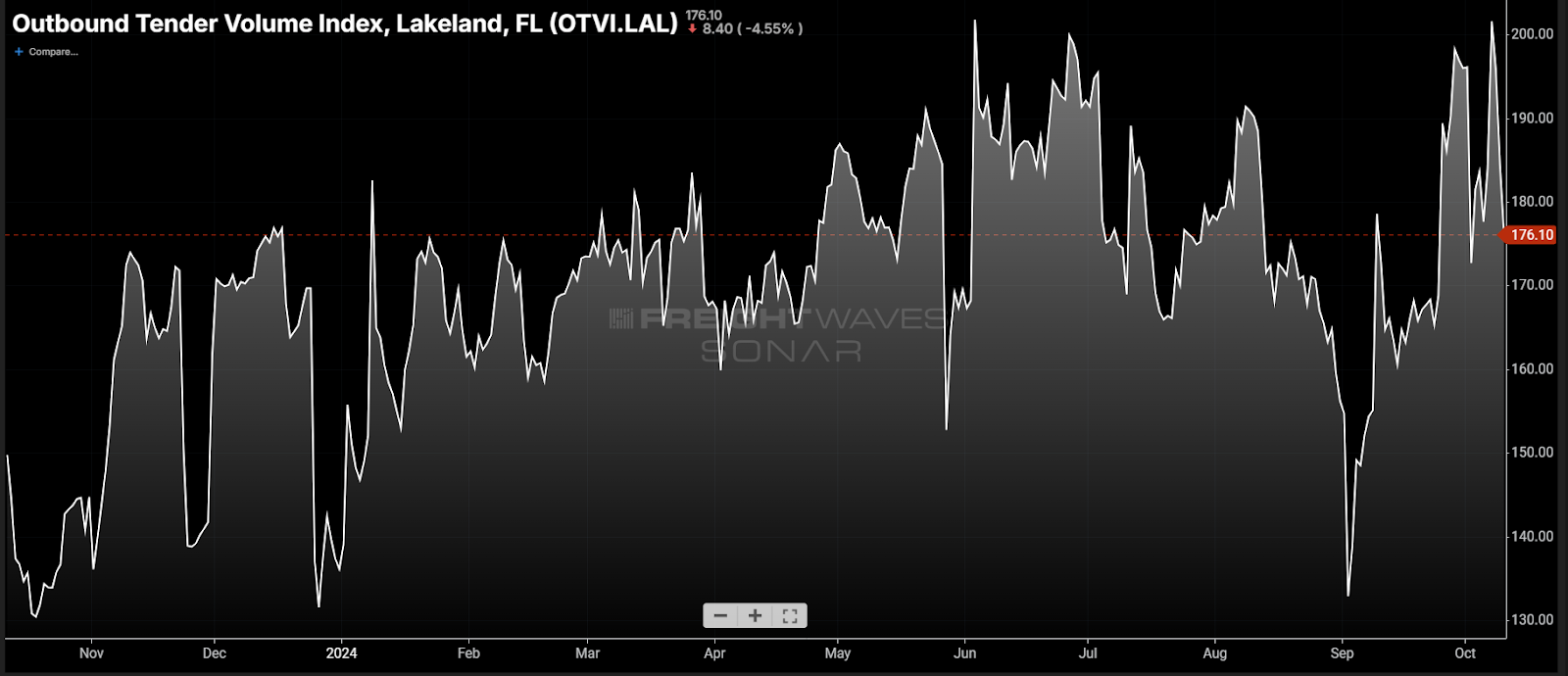

Incorporated rejection rates in the Lakeland market in central Florida have increased by more than 15%, the highest value since the epidemic period ends in early 2022.

Foreign debris also increased ahead of the storm, before quickly dropping as it made landfall.

This type of operation causes transportation problems for some time after the storm passes. The country’s freight market has been a well-oiled machine since the start of 2022, as there has been more than enough truck capacity to fill gaps in the event of a disruption.

To go back… to go back

Milton is the third major disruption to hit the national transport network in the past three weeks. Hurricane Helene made landfall in the Big Bend region of Florida’s Gulf Coast on September 26 as a Category 4 storm. Most of the damage occurred inland as the system quickly moved toward northern Georgia and the western part of the country. of the Carolinas. The storm caused extensive damage to the area but was not a major immediate disruption to transportation due to the lack of large presence of ships from other affected countries.

The following week, the International Longshoremen’s Association (ILA) went on strike for three days, resulting in several days of loss of container and shipping work around Eastern ports. Coast. Although many shippers were prepared for this, a slight deterioration was observed in the form of slight rejection and regional values.

Although ship captains could prepare, there was little they could do other than try to find other cargo to transport. This left them out of position when the strike ended. With the shipping people still prepared and the strike lasting only a few days, there was no strong sense of urgency to recover.

Milton was the most influential, at least on the surface. The timing of the system hitting on the heels of two other network-changing events may have had its negative impact.

Check the accommodation

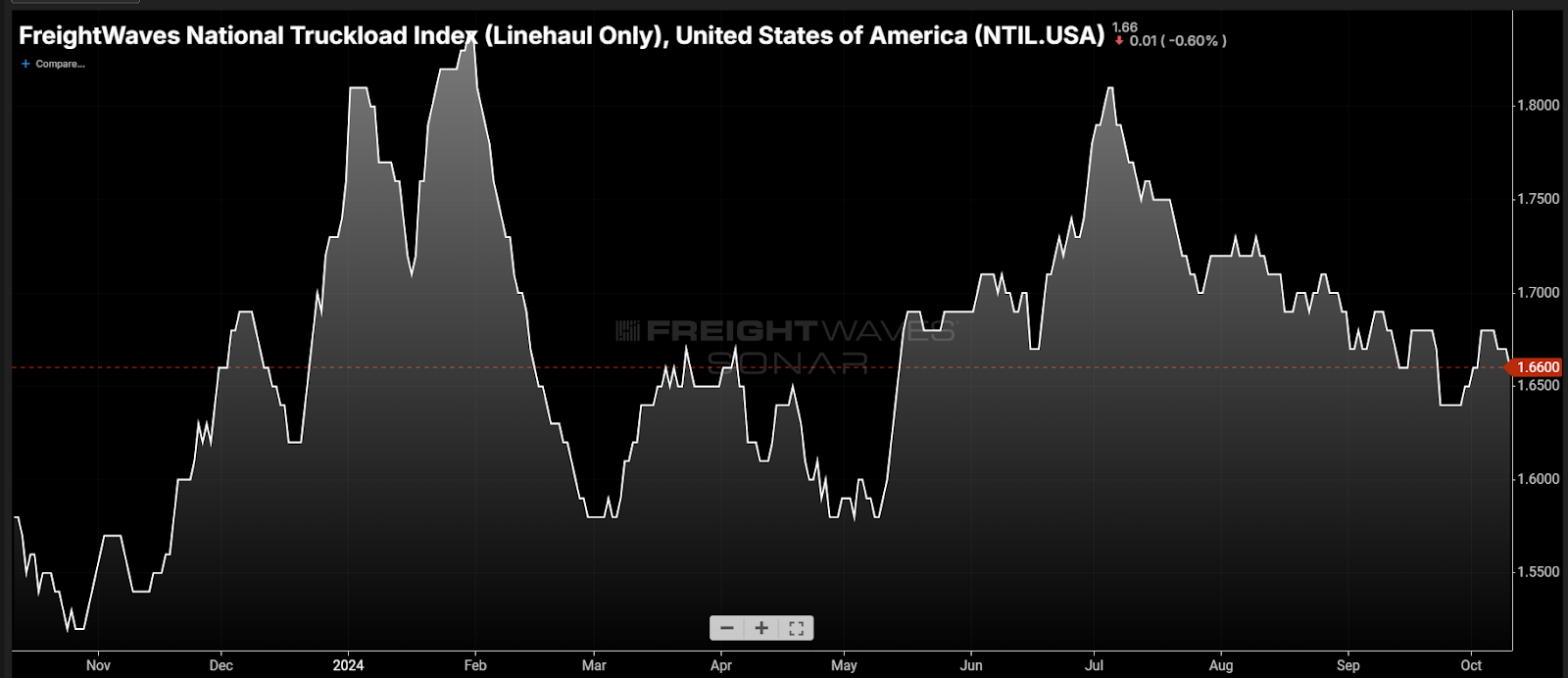

The local market was not quick to respond to Milton. As of Thursday, there was no major change in local rates. The National Truckload Index excluding the impact of fuel (NTIL) was down from Thursday. Spot and rejection rates often have a strong correlation, so why don’t spot rates react more than rejection in this situation?

Because carriers avoided the area in front of the storm, there was a lot of power available outside of the worst affected area and not enough equipment was acceptable to drive high rates. especially at the national level from that area. In other words, give it a minute.

As shippers return to work next week and relief efforts begin in earnest, there will be an upward trend in prices as capacity will be drawn into the region.

The Federal Emergency Management Agency will need help from state carriers, and yes, some of these burdens will pay better than what they get from existing customers, forcing them to decide between FEMA load and consumer load. The jury is out on the scale of this impact.

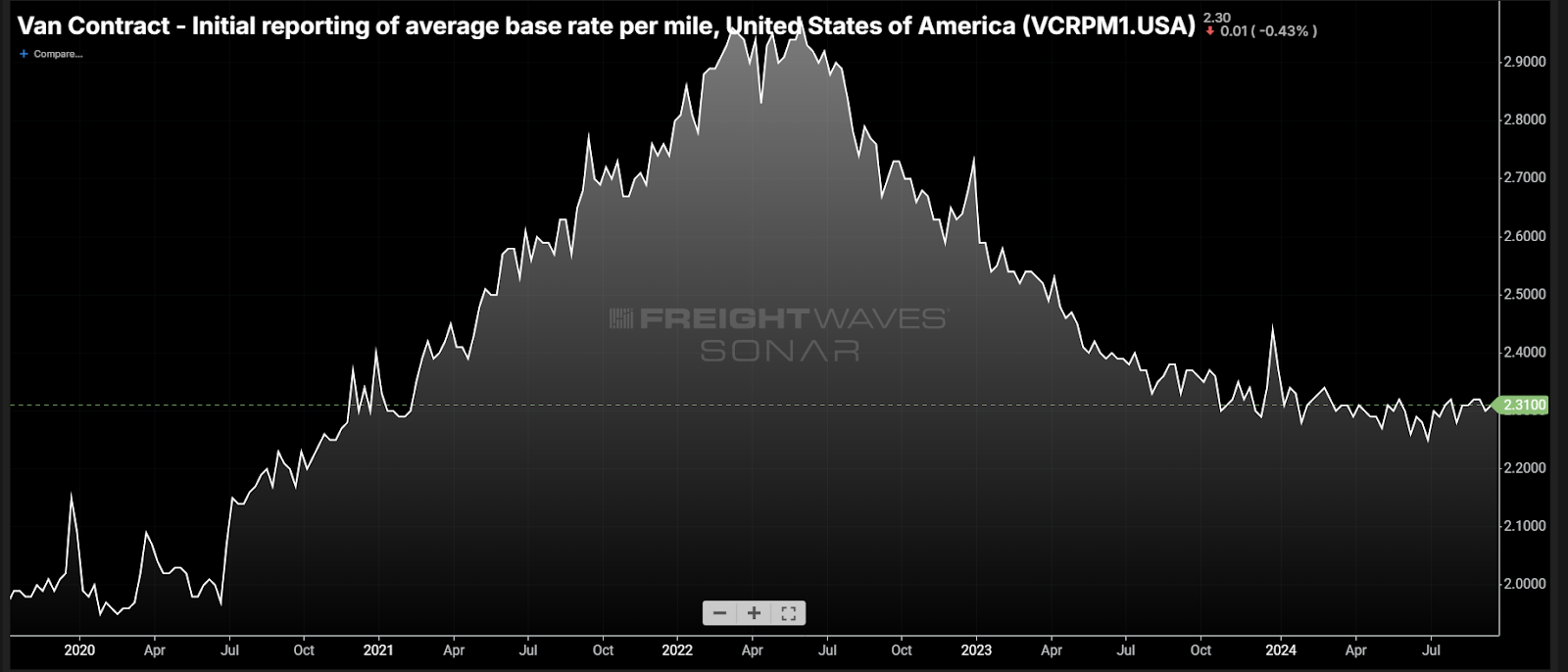

Contract prices are showing signs of bouncing back in an environment where they may be falling. Dry truck contract prices are down about 2% on the year but have slowed over the past six months and are up 1% in the past quarter.

This means that carriers have reached the limit of where they are willing to lower prices to do business in an area where supply is always plentiful. In other words, rates are low, and it won’t take much of a financial incentive to get carriers to move goods outside of their existing customer base.

The first wave of rejection is just a sign of not being able to deliver the goods. The next part will tell us exactly how vulnerable the market is based on how much laziness there is to enter and deal with the recovery.

October is typically a slow month for trucking, which causes the rejection rate to jump significantly. The transportation market seemed to be stable enough to handle two major events, but the jury is still out on the third. Much will be learned about where we are in the current overstocking journey in the coming weeks, leading up to the peak shipping season.

About the Weekly Chart

The Weekly FreightWaves chart is a chart option from SONAR that provides interesting data to explain the state of freight markets. Chart selection from thousands of charts available on SONAR helps participants see the stock market in real time. Each week Market Expert will post a chart, along with commentary, live on the front page. After that, the Weekly Chart will be saved on FreightWaves.com for future reference.

SONAR collects data from hundreds of sources, presents data in charts and maps and provides commentary on what property market experts want to know about the industry in real time.

FreightWaves’ data science and product teams deliver new tools every week and improve the customer experience.

To request a demo of SONAR, click here.

#Milton #created #stock #market