Stock Market Continues to Beat Records. What Can Stop a Rally?

Stocks are rising one after another.

The Morningstar US Market Index is up more than 21% so far this year, having rebounded since August. The list is up 65% since its launch in September 2022.

Kristy Akullian, head of investment strategy for iShares, Americas, at BlackRock, says: “We’ve been surprised by how resilient the equity markets have been, despite a lot of volatility in recent weeks. A few years ago, he pointed to the uncertainty surrounding the financial stimulus in China, and the neck-and-neck presidential election in the United States -rao in the technology sector, and fears of a decline in consumer spending: “In theory, all those things would be warning signs. But the market has taken everything seriously.”

What makes a strong union, and what can destroy it? Strategists say the surprisingly strong economy has given investors confidence and helped send stocks higher, but they also warn that problems in the earnings season could derail the bull run.

Why Stocks Are Going Up

“The most important thing about why every market has remained strong, even in the face of so much uncertainty, is that the economic data has surprised to up,” Akullian explains. “The conversation about a recession, at least for the foreseeable future, is really off the table.”

Inflation has fallen sharply over the past year, and recent labor market data has been healthy, allaying investor concerns about a sharp decline in hiring. Consumers are spending, wages are rising, and corporate profits are steady. That’s a big change from the start of this year, when jobs and inflation data seemed to point to the possibility of a recession. Add the Federal Reserve’s interest rate cuts to the mix, and you have a recipe for the strong gains seen over the past two months.

“As far as the market is concerned, we will have the Fed [as a] tailwind,” says Yung-Yu Ma, chief investment officer at BMO Wealth Management. “That gives a lot of motivation and boosts the situation.” On the other hand, a decrease in interest rates caused by worries about a recession can have a very different effect on investors.

With an easy-to-reach outlook, Ma said he expects interest rate cuts to reinvigorate the economy as companies waiting for interest rates to drop accelerate spending.

The Rally Expands

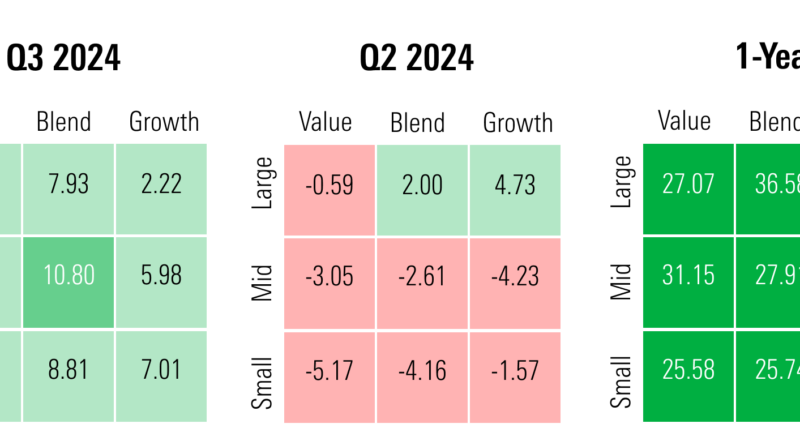

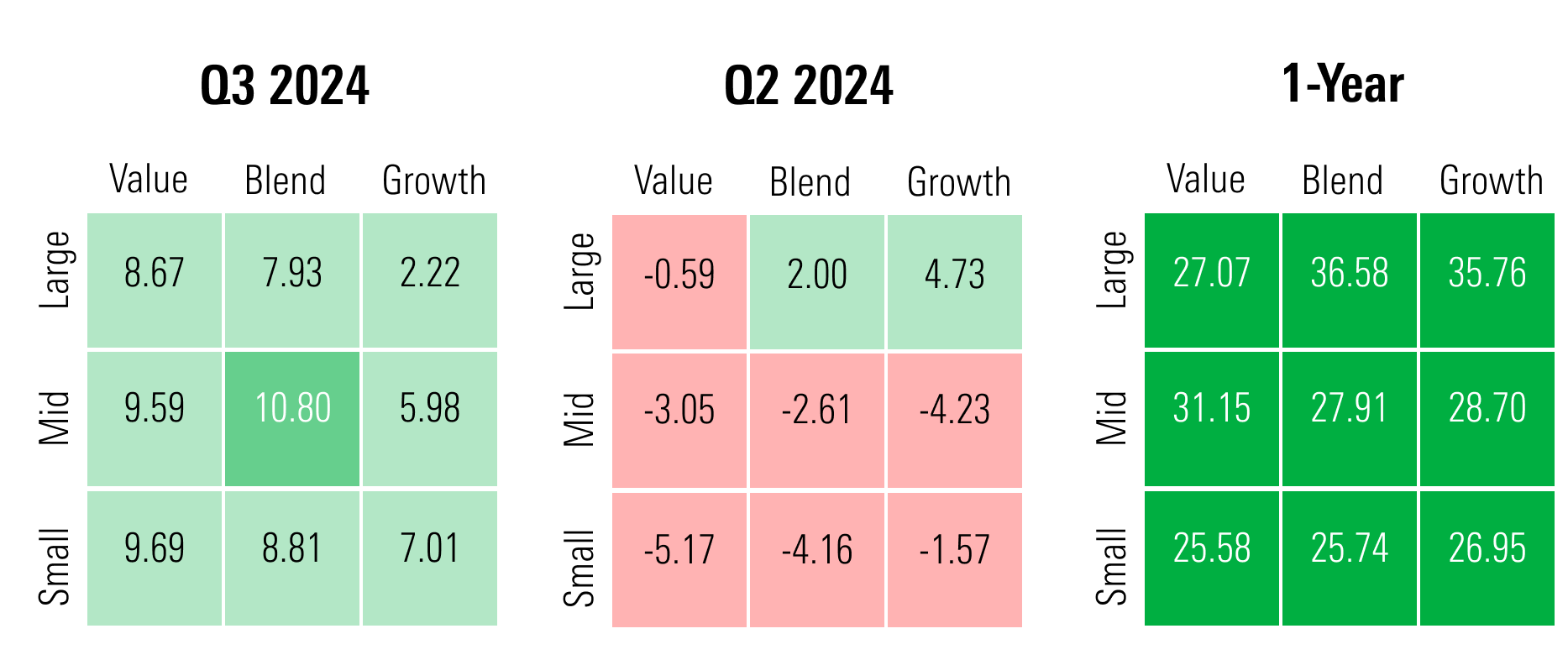

Growing confidence in the path of the economy and interest rates have helped fuel the recent shift from technology stocks to value and small capitalization stocks. After two years of eye-popping gains, large-cap stocks returned just 2.2% in the third quarter, while high-quality stocks gained 8.8%.

Bryant VanCronkhite, senior portfolio manager at Allspring Global Investments, says this is a positive development, although it may be painful for some investors to see the artificial intelligence business collapse. “You want a better supply across a broader group of companies,” he says. That is a sign of a healthy market and a sustainable rally.

Morningstar’s US chief analyst Dave Sekera also sees support for the markets continuing: “When we assess the market dynamics, we think that conditions from interest rate cuts, price reductions of money, easing monetary policy, and the latest sign of stimulus announced by the Chinese government. due to the slowdown in economic growth.”

Keep an eye on the rewards

Earnings season is underway, with major banks reporting their third quarter results. Corporate profits have remained strong overall despite headwinds from inflation, high interest rates, and national uncertainty, but policy experts warn that any major problems could derail markets.

James Ragan, director of wealth management research at DA Davidson, says: “If we get a couple of weeks into earnings season and miss the highs, I think that could hurt things.” “That would be the biggest risk going forward,” he says, though his outlook is for good results overall.

Analysts generally agree that companies in the US Market Index grew their earnings by an average of 4.3% in the third quarter, according to FactSet estimates. That’s below second-quarter growth of 10.3% and expectations for 11.7% growth for the fourth quarter. One of those differences is because the third quarter of 2023 saw very strong results, so the third quarter of 2024 growth looks small in comparison—an event analysts call a “baseline effect.” Falling oil prices are also expected to lower profits in the energy sector, lowering overall market forecasts.

Akullian said he will be paying more attention to how companies expect to perform later this year and into 2025. “What I would worry about is if we get more bleak guidance than the market expects.” , especially if that happens from the technology sector,” he said. If companies indicate that the latest earnings growth expectations for the next quarter or two are “overly optimistic,” he says, “that could cause a pullback as markets begin to reset expectations.” Q4 and more.”

When Will Using AI Pay Off?

Investor enthusiasm surrounding AI has sent tech stocks soaring over the past two years. Companies are investing heavily in this technology, but investors are worried about when that investment will start paying off. “Ultimately, these early winners have to justify the cost” through new revenue streams or expanded channels, VanCronkhite says. “Besides, you have to wonder if we’re ready for all these bright things that are supposed to happen with AI.”

Akullian thinks that if investors hear earnings guidance that increases these concerns, the market could collapse, due to the heavy weighting of technology stocks in the major indexes and the fact that expectations about AI they are made by the standards of many of the biggest tech companies. . However, many analysts remain bullish on AI. For example, after Advanced Micro Devices’ AMD “Advancing AI” event, Morningstar equity analyst Brian Colello wrote: “AMD’s line of sight on data center processors suggests no AI chip bubble In addition, we’ve received a lot of questions about what the size of the AI chip market might look like during growth (whenever that may be), and although we’re optimistic that the industry will not grow at 25% per year forever, it may not be a flat market in the next five or 10 years.”

Ma says technologists with deep pockets are unlikely to turn their backs on AI any time soon, adding that anecdotal evidence of the technology’s success is starting to trickle down. “We think that will continue for a while, regardless of the [question] of ‘Are we seeing the payoff?’” he says.

Key Point for Investors

Nothing is guaranteed when it comes to stocks. A mild recession is still in sight, but the economy is also likely to slow down. “This is a very unusual cycle related to history,” says VanCronkhite. “Our ability to predict the future on a large scale is much worse than it might have been in the past.”

Policy experts recommend a balanced approach to managing many unknown factors, including the path of the economy, the outcome of the presidential election, and political developments. “What’s important going forward is diversification,” says Akullian, who adds that he still sees more opportunities in the stock market.

Although the mega-cap technology business may have worked in the past, investors should expect that financial products will look different in the coming months. Ragan adds that the current strength of technology means that it can be a good opportunity for investors to be willing to return to underperforming areas that can benefit as the merger continues to spread. But he advises to “stick to high quality. Stick to companies with less visibility for continued earnings growth. ”

#Stock #Market #Continues #Beat #Records #Stop #Rally