The market doesn’t like what it’s seeing from Moderna, Inc.’s (NASDAQ:MRNA) stock, however, which is up 28%.

Unfortunately for some shareholders, the Moderna, Inc. (NASDAQ:MRNA) share price is down 28% in the last thirty days, prolonging the recent pain. Instead of being rewarded, shareholders who have been holding for the past twelve months are now sitting on a 44% price drop.

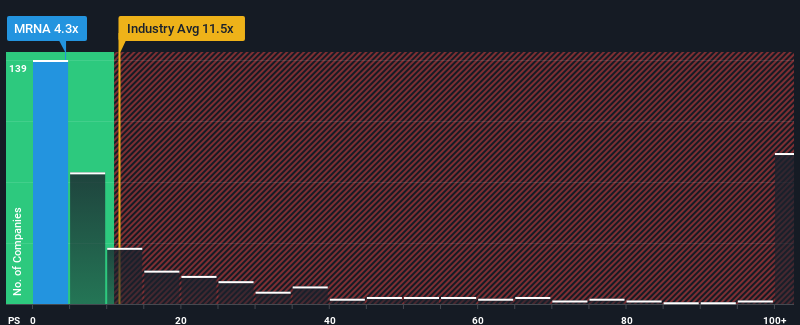

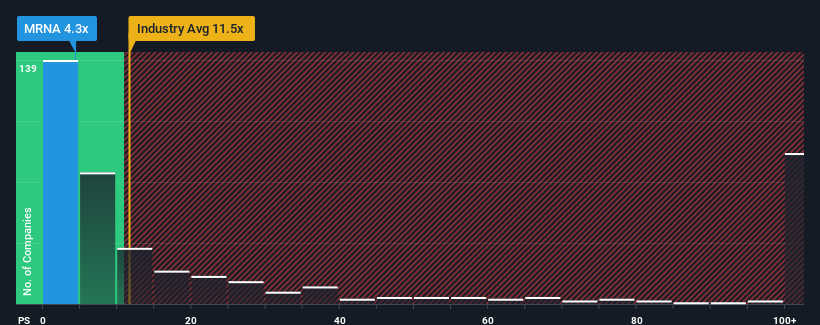

After such a steep decline, Moderna’s price-to-sale (or “P/S”) ratio of 4.3x makes it look like a strong buy right now compared to the broader US Biotechs industry. , where about half. of companies with P/S ratios above 11.5x and even P/S above 67x are very common. However, it is not wise to take P/S at face value as there may be an explanation as to why it is limited.

Check out our latest Moderna review

How Moderna has been working

Moderna has not been a good performer recently as its revenue has been falling compared to other companies, which have seen some growth in their earnings on average. It appears that many expect the poor earnings performance to continue, which has shaped the P/S ratio. So even if you say the stock is cheap, investors will look for improvement before they see it as a good value.

Curious about how analysts think Moderna’s future will shape the industry? In that case, we for free A report is a good place to start.

Are Earnings Forecasts Consistent with Low P/S Ratios?

Moderna’s P/S ratio would be typical for a company expected to deliver very negative growth or declining earnings, and more importantly, underperform the industry.

Looking back, the company’s revenue growth last year was nothing to cheer about as it posted a disappointing 53% decline. As a result, revenue from the last three years has also dropped by 28% overall. Therefore, it is fair to say that recent revenue growth has been unfavorable for the company.

Looking ahead now, revenue is expected to rise 0.2% annually over the next three years according to analysts who follow the company. Meanwhile, another industry is expected to grow by 146% per year, which is even more impressive.

Because of this, it makes sense that Moderna’s P/S sits below many other companies. It appears that many investors expect to see less growth in the future and are willing to pay less for the stock.

What Does Moderna’s P/S Mean for Investors?

Moderna’s P/S looks as weak as its price lately. Arguably the price-to-sales ratio is an undervalued measure within certain industries, but it can be a powerful indicator of business sentiment.

As we suspected, our review of Moderna’s analyst forecasts revealed that its low revenue outlook is contributing to its low P/S. Shareholders are now accepting a low P/S as they believe that future earnings will not provide any surprises. It is difficult to see the share price rising strongly in the near future under these conditions.

A company’s balance sheet is another important part of risk assessment. Check out ours for free check sheet for Moderna with six easy checks on some of these key points.

If these risks make you rethink your opinion of Modernacheck out our interactive list of high-quality products to get an idea of what else is out there.

New: Manage all your stock portfolios in one place

We made the ultimate portfolio partner for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Alerting of New Warning Signs or Hazards by email or phone

• Track the Quality of your goods

Try Demo Portfolio for free

Have a comment about this article? Are you concerned about the news? Get together and us directly. Alternatively, email the editors (at) simplywallst.com.

This Simply Wall St article is general in nature. We provide opinions based on historical data and analyst estimates using an unbiased approach and our articles are not intended as financial advice. It does not make an offer to buy or sell any property, and does not consider your motives, or your financial situation. We are committed to bringing you long-term analysis focused on fundamentals. Note that our review may not include recent company announcements that are not sensitive to pricing or quality equipment. Simply Wall St has no position in the stocks mentioned.

#market #doesnt #Moderna #Inc.s #NASDAQMRNA #stock